Award-winning PDF software

2019-2025 1094 b instructions Form: What You Should Know

Forms 1096-T and 1096-U-RSA are Non-Exempt Employer Health Plans, Reportable to the IRS Jun 12, 2025 — In accordance with the Patient Protection and Affordable Care Act, the IRS has issued a final regulation making Form 896-T (Reportable Information Return) required for all employers Including those exempt from providing health insurance as of June 12, 2025. Final Regulations Exempting Employers from Providing Health Insurance in 2025 and Beyond Mar 12, 2025 — The new regulations exempting employers from providing health insurance in 2025 and beyond have been signed into law. These rules and regulations are effective October 1, 2017, and prohibit certain employers from providing health coverage. Employer Health Insurance Exemptions as of July 3, 2021; Employer Health Coverage Defined — IRS Dec 7, 2025 — Effective dates have been set for two rules eliminating certain employer health benefit plans (health plan coverage not required to satisfy any requirement in the statute). Final Rule Revisions for Employer Coverage of Anesthesia Services under Medicare — IRS Jun 15, 2025 — The Affordable Care Act eliminates certain limitations on the amount of anesthesia services employers can pay for an outpatient appointment. In compliance with the law, the IRS, in a final rule, has issued final regulations clarifying the amount of anesthesia services that Employers are required to pay in addition to the amount required under the law. Frequently Asked Questions about Health Insurance Tax There are 2 versions of the tax, the 2-digit Social Security number (SSN) and an annual income that is used for determining the payment amount. The 2-digit SSN (your Social Security number) is used to determine if you file a tax return and determine your payment amount. The 2-digit annual income (the amount from 1 to 59) is used to determine the payment amount and the payment period. In addition, if you are age 65 and older you must have a tax file number (if you don't have one, you must file a tax return and pay taxes on Schedule A. However, the IRS will accept your social security number, but you cannot file a tax return if you don't have a tax file number.

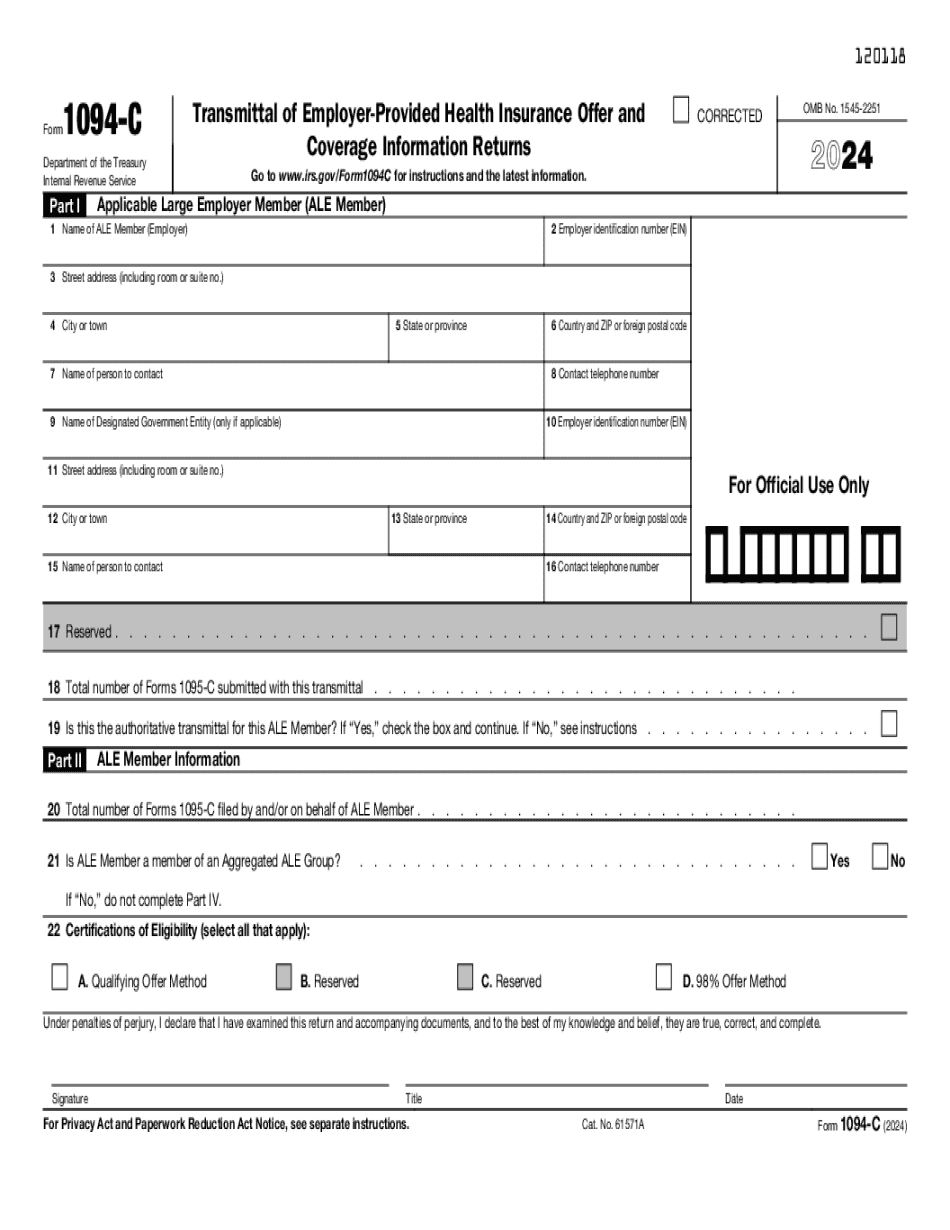

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1094-C, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1094-C online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1094-C by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1094-C from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.